Mortgage Articles

Buying a home is one of the biggest financial moves you’ll ever make — and along with it comes a whole lot of new terms, rules, and (you guessed it) insurance . You might think “Mortgage insurance… how complicated can that be?” But once you start hearing about default insurance , mortgage life insurance , and home insurance , it’s easy to get lost in the fine print. Don’t worry — this guide breaks it all d own so you can feel confident about what each type does, what it costs, and why it matters.

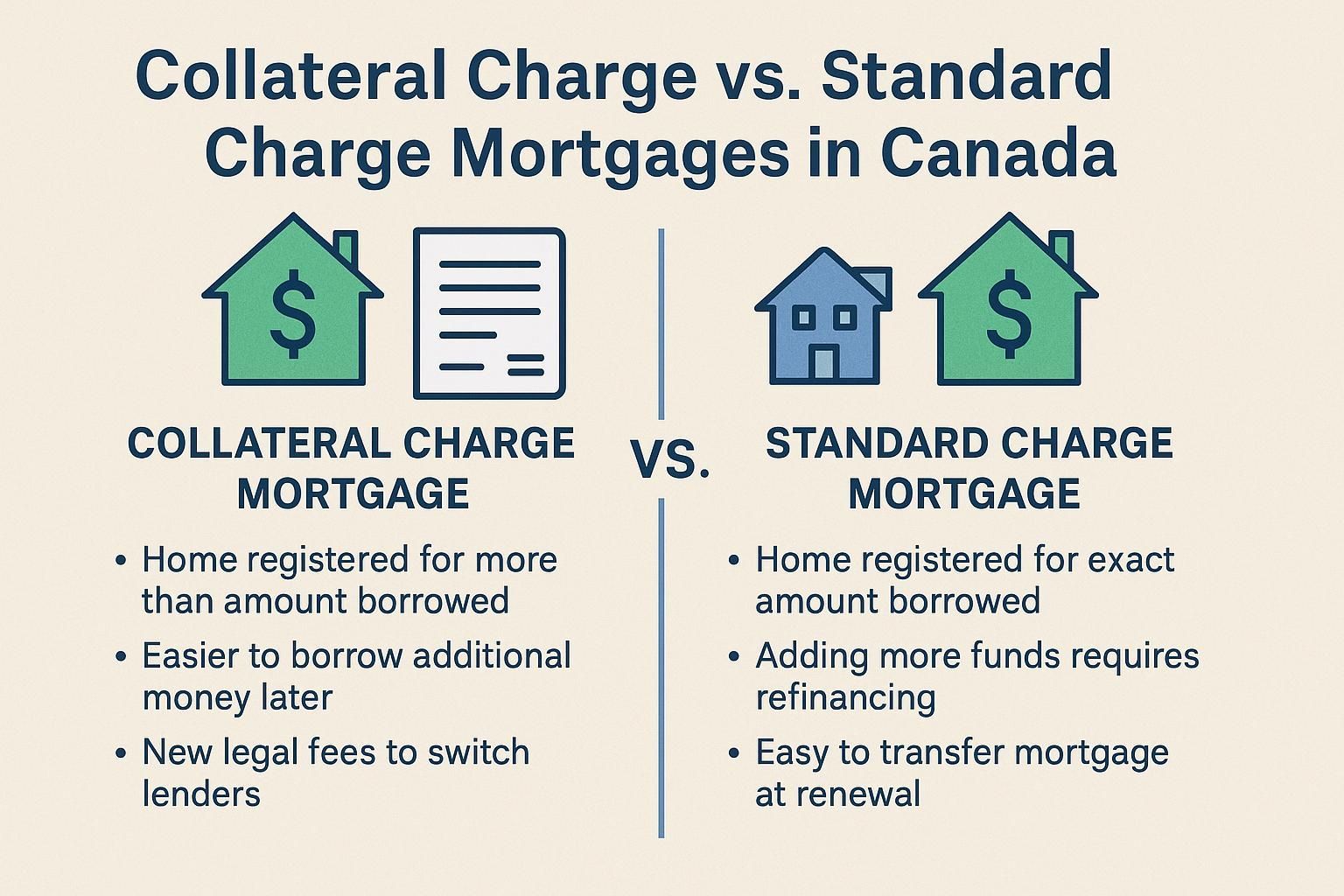

When you’re buying a home in Canada, you’ll hear a lot of new terms. One of those is how your mortgage is registered: as a standard charge or a collateral charge . This choice matters because it affects your flexibility, your costs if you ever switch lenders, and how easy it is to borrow more money later. Let’s break it down in simple terms.

British Columbia’s real estate landscape has changed dramatically over the past 15 years. Since 2010, we've seen waves of new legislation, tax policies, zoning reforms, and consumer protections that affect how homes are bought, sold, financed—and lived in. Whether you're a first-time homebuyer or a seasoned investor, keeping up with all these changes can feel overwhelming. That’s why working with a knowledgeable mortgage broker has become more important than ever. Here are 20 key real estate changes in BC since 2010 —and how they affect you.

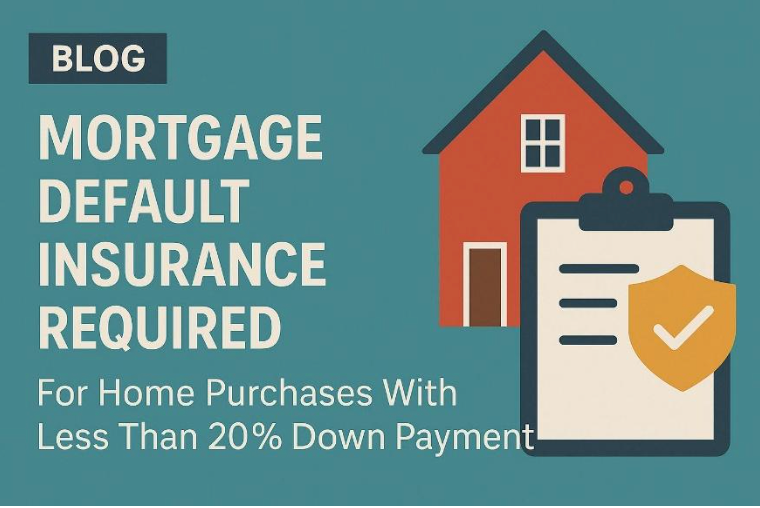

Home buyers say the #1 obstacle to homeownership is saving enough money for a down payment. Mortgage default insurance (also called mortgage insurance) allows you to purchase a home with as little as 5% down . It protects your lender if you stop making payments. Typically, a 20% or higher down payment is your best option. However, for many Canadians, reaching this amount can be challenging, especially in expensive markets like Greater Vancouver & Toronto. If you don't have enough cash for a 20% down payment, Mortgage Default Insurance can help. How Much Down Payment Do You Need?

Have you ever dreamed of buying a piece of land and building your very own home from scratch? You're not alone! Buying bare land, especially in beautiful British Columbia, Canada, can be an exciting adventure or a money pit. Before you start dreaming of where to put your future house, there are a few important things you should know. What is Bare Land? Bare land, sometimes called vacant land, is just that—land without any buildings or structures on it. It's an empty canvas waiting for your ideas. But buying bare land isn’t quite the same as buying a house or apartment. It comes with its own set of rules and challenges, especially when it comes to financing. Why is Financing Bare Land Different? When you buy a home, Lenders feel safer lending you money because if something goes wrong, they can sell the house to get their money back. With bare land, it’s different because there’s nothing built yet. It’s harder to sell bare land – than a home. Which makes it riskier for Lenders, therefore they usually have stricter lending rules and higher interest rates to offset the risk. Important Things to Consider About Financing Bare Land: 1. Down Payments Can Be High Raw Land : This is completely untouched land without any utilities like water, sewer, electricity, or roads. Lenders often require a large down payment, sometimes around 50% of the land’s price. Due to the higher perceived risk, many lenders do not lend on raw, undeveloped land. Vacant or Serviced Land : This land already has important utilities (like electricity, water, sewer, gas, telecommunications, and road access) nearby or already installed. Because it's easier to build on, Lenders may require a slightly lower down payment, usually around 35%. 2. Higher Interest Rates and Shorter Loan Terms Interest rates on land loans are generally higher than on regular home loans because of the increased risk. Also, Lenders might offer shorter loan terms. Some lenders may offer loans where you only pay interest for a few years, which can help lower your monthly payments in the short term. 3. Finding the Right Lender There are three main places to get a land loan: Traditional Banks : Major banks sometimes provide land loans but usually with strict rules, high down payments, and higher interest rates. Credit Unions : Local credit unions can often have more flexible rules and may offer better terms, especially if the land is within their local lending area. Private Lenders : Companies specifically dealing with land financing. They offer customized loans but typically charge fees for borrowing the money and higher interest rates.

Are you debating whether it's smarter to rent or buy a home in Canada? It's a common question, and the answer depends on your personal situation. Both renting and buying have their pros and cons, but for most people, homeownership tends to offer substantial long-term benefits. Let’s explore both options clearly, so you can confidently decide what’s best for you. Advantages of Buying a Home 1. Personal Freedom and Customization Owning your home means having the freedom to personalize your living space. Dreaming of a bold paint colour or unique flooring? Go ahead—your home, your rules! 2. Building Equity and Wealth Each mortgage payment you make is an investment in yourself. Over time, your home typically appreciates in value, increasing your equity. This can become a significant asset that helps secure your financial future. 3. Stability and Security Owning offers peace of mind. You don’t need to worry about sudden rent hikes or eviction notices. Your home remains yours until you decide otherwise. 4. Long-Term Financial Benefits Homeownership acts as forced savings. Unlike renting, every mortgage payment moves you closer to outright ownership, building a financial foundation that can support you and your family for years to come. Challenges of Buying a Home 1. Upfront Costs Buying comes with significant initial costs, including a down payment, legal fees, home inspection, appraisal, moving expenses, etc. 2. Responsibility for Maintenance Owning a home means you're responsible for maintenance and repairs. This can sometimes be costly and inconvenient. 3. Reduced Flexibility Selling a home typically takes time, which can limit your flexibility if you need or want to relocate quickly. Advantages of Renting 1. Easy Mobility Renting offers flexibility to relocate easily, beneficial for frequent job changes or lifestyle adjustments. 2. Fewer Responsibilities Repairs and maintenance are generally your landlord’s responsibility, reducing stress and unexpected expenses. 3. Lower Initial Costs Renting typically requires just a security deposit and the first month's rent, making it easier financially at the start. Downsides of Renting 1. No Equity Building Rent payments do not contribute to your equity. Instead, you’re effectively paying your landlord’s mortgage, offering no long-term financial return. 2. Restrictions and Rules Landlords often impose limitations, such as no pets or restrictions on decorating, making it challenging to feel fully at home. 3. Instability and Uncertainty Renters may face sudden rent increases or eviction if the landlord decides to sell or repurpose the property, disrupting your life significantly.