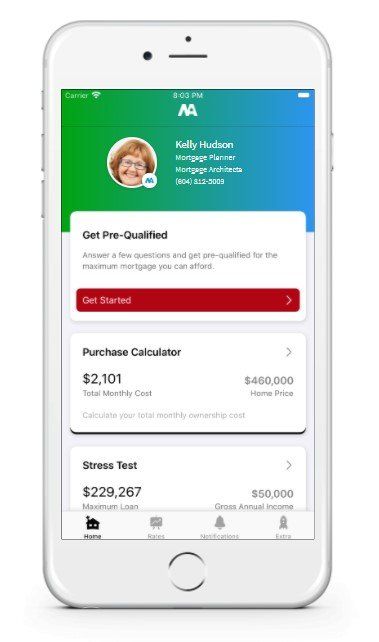

Kelly Hudson

LET’S WORK TOGETHER TO GET YOU THE BEST MORTGAGE AVAILABLE

LET'S TALK

Hi, I’m Kelly. I’m a Mortgage Broker, living in Richmond and servicing the Greater Vancouver area and beyond for the last 11+ years.

Buying a home is both: exciting and nerve wracking. My goal is to simplify and educate you about mortgage financing, so you make good decisions based on your situation.

As a Mortgage Broker - I specialize in Mortgage Intelligence, educating people about mortgages, how they work and what lenders are looking for. Everyone's home purchasing situation is different, so working with me will give you a better sense of what mortgage options are available based on the 4 strategic priorities that every mortgage needs to balance:

- lowest cost

- lowest payment

- maximum flexibility

- lowest risk

The fine print in the mortgage contract can far outweigh the rate being offered. Most people are blinded by the rate, in their quest for a mortgage.

- Rates are #1 & #10 on your list, we discuss the other 8 areas of the mortgage, to ensure you find the best fit for your circumstance.

In a perfect world I would LOVE to meet people 3 months-3 years prior to them planning on purchasing a home, so I can work with them to put together a home ownership game plan.

My services for a typical mortgage are FREE (I get a finder’s fee from the lender) and I help people save money. I LOVE my job!

My mortgage brokering services include:

- PURCHASING your first home

- REFINANCING for renovations, investments or debt consolidation

- RENEWING your current mortgage

- INVESTING in a rental/revenue property/cottage

- REVERSE MORTGAGE for Homeowners age 55+, enabling them to access the equity in their home to let them live life on their terms.

If you would like to discuss mortgage financing with me, please contact me!

A little about me - I've lived in Richmond for 40+ years, have 1 husband (George), love animals including my 2 rescue poochies (Sophie & Sam). For fun, I enjoy socializing, travel & baking (especially cookies and cupcakes) & I’m practically addicted to Hawkins Cheezies & Jujube’s!!

My Process is Simple.

Get in Touch

Choose a Solution

Enhance your Lifestyle

Want to get started right away?

APPLY NOWSimple mortgage advice, honestly given!