Mortgage Insurance 101 Revised Nov 2025

Buying a home is one of the biggest financial moves you’ll ever make — and along with it comes a whole lot of new terms, rules, and (you guessed it) insurance.

You might think “Mortgage insurance… how complicated can that be?” But once you start hearing about default insurance, mortgage life insurance, and home insurance, it’s easy to get lost in the fine print.

Don’t worry — this guide breaks it all down so you can feel confident about what each type does, what it costs, and why it matters.

1. Mortgage Default Insurance – Protects the Lender, Not You

Let’s start with the one most first-time buyers hear about first: Mortgage Default Insurance.

In Canada, this insurance is mandatory if you put less than 20% down payment on your home. This insurance protects your lender, not you.

If you ever stop making your mortgage payments (called defaulting), this insurance kicks in to make sure the lender doesn’t lose money.

- HOWEVER the insurance company will come after you to get their money.

There are three companies in Canada that provide this type of insurance:

- CMHC (Canada Mortgage & Housing Corporation)

- Sagen (formerly Genworth)

- Canada Guaranty

You don’t need to do anything on your side since your lender decides which insurer they want to work with.

How much does it cost?

The cost (called the premium) is based on your down payment amount and is added to your mortgage. Here’s a quick example:

- If you buy a $600,000 home with 10% down, your default insurance premium might be about 3.1% of your mortgage amount — roughly $16,740, which added to your mortgage loan (you don’t need to come up with the cash).

It sounds like a lot, but the good news is that this insurance allows homebuyers with smaller down payments to get into the market sooner, instead of waiting years to save 20%.

👉 Fun fact: As of December 15, 2024, first-time buyers purchasing newly built homes can now qualify for 30-year amortizations with insured mortgages — a big win for affordability!

For a deep dive, check out my other BLOG: Everything You Wanted to Know about Mortgage Default Insurance

2. Mortgage Insurance vs. Life Insurance – What’s the Difference?

Once you have your mortgage, you need to decide: “Would you like to add mortgage insurance to protect your loan?”

That’s when things can get confusing — because mortgage insurance in this case isn’t the same as mortgage default insurance.

This version is about protecting you and your family, not the lender.

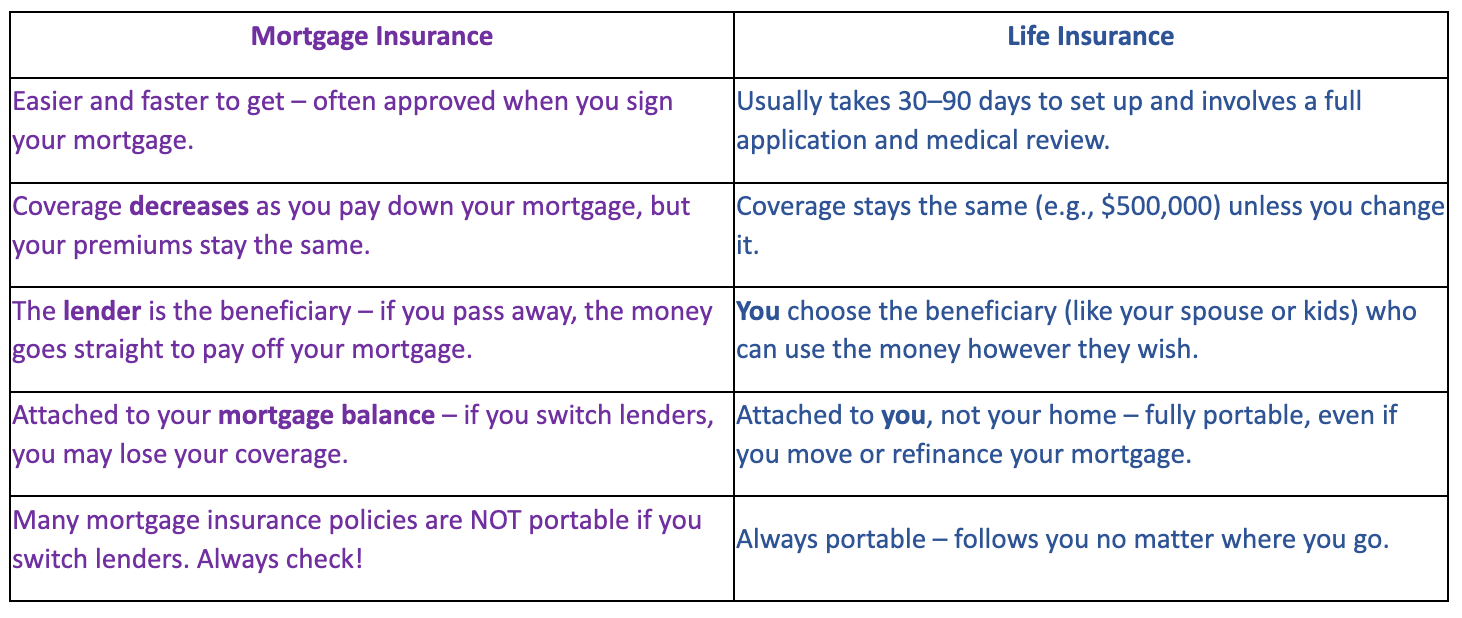

Let’s compare

mortgage insurance to

life insurance so you can see how they differ:

So which one’s better?

That depends on your needs.

Mortgage insurance can be convenient, especially if you want quick, no-hassle coverage when buying your first home. But a personal life insurance policy can offer more flexibility and control, especially if you want your family to choose how to use the funds.

Remember: You don’t need mortgage or life insurance to qualify for a mortgage. But having the right kind of protection gives you peace of mind — and that’s priceless.

Here are the Top 4 Benefits of getting life or mortgage insurance when you buy a home:

- Peace of Mind – You’ll sleep better knowing you (and your family) are financially protected.

- The Mortgage Can Be Paid Off – Your loved ones won’t have to worry about losing their home.

- Your Family Can Stay in Their Home – During a difficult time, keeping stability matters more than ever.

- It’s Cheaper When You’re Young – The younger and healthier you are, the lower your premiums.

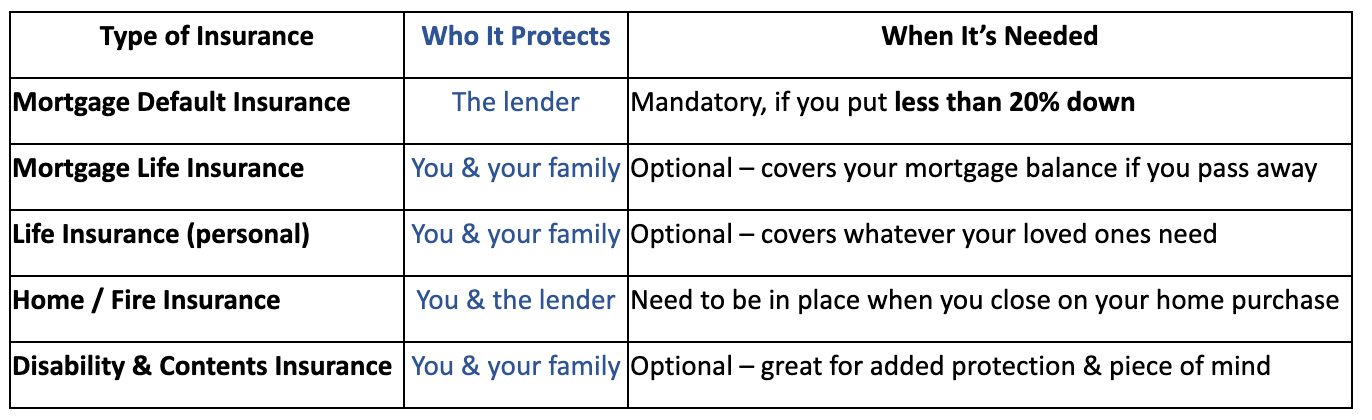

3. Other Important Types of Insurance

While we’re on the topic, here are a few other kinds of insurance every homeowner should know about:

🔥 Fire / Home Insurance

Before your mortgage can be funded, your lender will ask for proof of home insurance (often called fire insurance).

This protects both you and the lender if your home is damaged or destroyed. You’ll want to make sure it covers replacement cost, not just market value.

- Some policies even cover temporary living costs if your home becomes unlivable after a fire or flood.

💼 Disability Insurance

This one protects your income. If an accident or illness stops you from working, disability insurance can help cover your mortgage payments and other bills while you recover.

🛋️ Contents Insurance

Also called

personal property insurance, this covers all your stuff — furniture, clothes, electronics, etc. — if it’s damaged or stolen.

4. Quick Recap

Here’s a simple way to remember it all:

The Bottom Line

Mortgages can feel complicated — but they don’t have to be!

Understanding the different kinds of insurance helps you protect your home, your family, and your financial future.

When you’re working with a mortgage expert, you don’t have to figure it all out alone. I’ll walk you through which coverage makes sense for your budget and lifestyle — and connect you with trusted, reputable insurance professionals when you need them.

Because at the end of the day, your home isn’t just an investment — it’s where life happens. 💚

Have questions about your mortgage or insurance options? Let’s chat!

Kelly Hudson

Mortgage Broker – Mortgage Architects – A Better Way

Mobile: 604-312-5009

Kelly@KellyHudsonMortgages.com

www.KellyHudsonMortgages.com