What Happens to My Mortgage Payment if Interest Rates Double??

Are you freaked out with all the negative press lately about rising interest rates?

One thing you can do to alleviate that fear is to educate yourself.

Let’s ask few questions – what is your current mortgage rate? How much are your monthly payments?

What would happen if your Fixed mortgage rates doubled, when it comes time to renew (typically 5 years)? Will you be able to afford your home? Will you have to adjust your lifestyle?

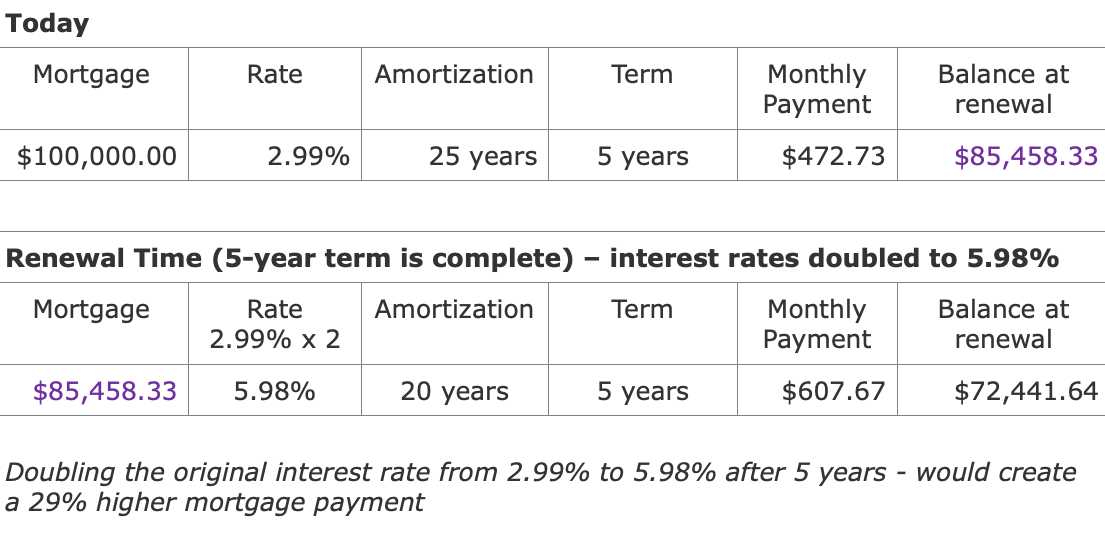

Does a doubling of the interest-rate double your mortgage payment? The short answer is NO it does not.

Let’s discuss the math and the logic.

I have used 25-year amortization, the maximum allowed for purchases with less than 20% down payment. This is usually the first-time home buyers – which tend to be the highest risk group.

I’ve used a $100,000 mortgage as an example, which makes it easy to do the math for higher mortgages.

The net monthly payment increase, at the 5-year renewal would be $134.94 per $100K of the original mortgage balance.

The net monthly payment increase, at the 5-year renewal refinanced over 25 years would be $73.02 per $100K of the original mortgage balance.

Now for the Logic:

Think of how much money you made 5 years ago… do you make more money now? Do you think your household income will increase over the next 5 years? Do you think your additional income would be enough to offset what you would pay if your mortgage interest rate doubled?

Over 5 years, an average family would experience an increase in household income.

How do rising mortgage rates affect you personally?

After looking at the math and the logic, clearly a doubling of mortgage interest rates would be unlikely to cause any kind of significant crisis for most average homeowners, and there are options available:

- refinancing your mortgage to lock into current rates

- increase your current principal payment and accelerate your mortgage repayment – this way your principal amount is lower when you’re refinancing.

Rising mortgage rates are discussed frequently and will continue to be discussed, as long as people have mortgages.

The best way to you prepare for the adversity of higher interest rates, is to shrink your mortgage balance as much and as quickly possible, especially with the current low mortgage rates, so more of your money pays off the principal.

If you have any further questions about mortgages, let’s chat.

My services for a typical mortgage are FREE and I help people save money. I LOVE my job!

Kelly Hudson

Mortgage Broker

Mortgage Architects

Mobile 604-312-5009

Kelly@KellyHudsonMortgages.com

KellyHudsonMortgages.com